Terms of use & Agreement

Thank you for selecting the Services offered by Valuefy Solutions Private Limited and/or its subsidiaries and affiliates (referred to as " VALUEFY ", "we", "our", or "us") via it's www.invezta.com and mobile application on iOS and android platforms.

Review these Terms of Service

("Agreement") thoroughly. This Agreement is a legal agreement between you and VALUEFY.

By accepting electronically (for example,

clicking "I Agree"), installing, accessing or using the Services, you agree to these terms.

If you do not agree to this Agreement, then

you may not use the Services. This Investment and transaction agreement sets forth the terms upon which

Client avails investment recommendation and transaction from Invezta platform.

Agreement

This Investment Platformy Services Agreement

("Agreement") is made at Mumbai, Maharashtra and on the "Date"

BETWEEN

Valuefy Solutions Private Limited, a body corporate, incorporated under the provisions of the Companies Act,

1956, having its registered office at 901, 9th Floor Coral Square, Near Suraj Water Park Vijay Garden Naka,

Ghodbunder Road, Thane West, Thane - 400615.

Herein after called "VALUEFY" (which expression shall, unless repugnant to the context or meaning

thereof, be deemed to mean and include its successors and assigns) of the ONE PART.

AND

Customer, [hereinafter called "the Client" which expression shall, unless repugnant to the context or

meaning thereof, be deemed to mean and include (if the Client is individual) his/her heirs, executors,

administrators and legal representatives and permitted assigns; (if the Client is a Partnership Firm), the

partners for the time being of the said firm, the survivor or survivors of them and their respective heirs,

executors, administrators and legal representatives/its successors and permitted assigns; (where the Client

is a Company or a body corporate) its successors and permitted assigns; (where the Client is the Karta of a

Hindu Undivided Family), the members for the time being of the said Hindu Undivided Family and their

respective heirs, executors, administrators and assigns; (where the Client is the Trust), the principal

trustee or the board of trustees or the trustees or person authorised by the board of trustees for the time

being and from time to time (where the Client is the governing body of a society), the respective successors

of the members of the governing body for the time being and from time to time the members of the society for

the time being and from time to time and any new members elected or appointed] of the OTHER PART.

WHEREAS:

VALUEFY is an mutual fund distributor registered with AMFI

under ARN no - 171537

The Client is desirous of obtaining

Investment recommendation and online execution services from Invezta platform

The Client has satisfied itself that Invezta

platform possesses requisite level of knowledge and competence to provide online investment recommendation

bundled in the product package.

VALUEFY has satisfied and shall continuously

satisfy itself about the genuineness and financial soundness of the Client and investment objectives

relevant to the Investment Platform & Transaction Services to be provided.

NOW THIS AGREEMENT WITNESSETH AND IT IS

AGREED BY AND BETWEEN THE PARTIES AS UNDER:

Mutual Fund Services

Declaration by the client

1) I / We have read and understood the contents of all the scheme

related documents including but not limited to Statement of Additional Information and Scheme Information

Document, Key Information Memorandum (KIM), addenda issued thereto and Product Label of the Scheme(s) before

making the investment.

2) I / We agree to abide by the terms, conditions, rules, regulations

and take note of the risk factors of the respective scheme(s) as on the date of this transaction.

3) I / We have neither received nor been induced by any rebate or

gifts, directly or indirectly in making the above transaction.

4) I / We hereby declare that I am / We are authorized to make the

above transaction and the amount invested by me / us in the scheme(s) is through legitimate sources only and

does not involve and is not designed for the purpose of any contravention or evasion of any Act, Rules,

Regulations, Notifications or Directions issued any statutory or regulatory or government authority from

time to time.

5) Only applicable in case of investment by NRIs):I / We confirm that

the I am / We are Non-Resident(s) of Indian Nationality / Origin and that the funds for additional purchases

are remitted from abroad through approved banking channels or from funds in my / our NRE/ NRO / FCNR

account. I / We are a resident / incorporated body under the laws of United States of America or Canada and

I/We will invest in only those AMCs which are communicated to me by Invezta Investment Platform . I/We will

be held responsible for investments made in the AMCs not communicated by Invezta Investment Platform . All

users in countries other than India understand that by using the service, they may be violating the local

laws in such countries. If the User chooses to access the service from outside India, he/she shall be solely

responsible for compliance with foreign and local laws. The Users agree that they will solely be liable for

any liability incurred in this regard and will indemnify Invezta Investment Platform for any liability

Invezta Investment Platform may incur in any foreign jurisdiction as a consequence of the citizens /

residents of countries other than India using the Service. This plan does not constitute an offer to sell or

a solicitation to any person in any jurisdiction where it is unlawful to make such an offer or solicitation.

7) I understand that Mutual fund and Securities are subject to market

risks and there can be no assurance that the objectives of the schemes will be achieved.

8) I/We agree to the terms and conditions for transacting through

Invezta Investment Platform Investment Account as mentioned below

9) I/We hereby give my/our consent for capturing and tagging the

ARN No.171537 of Valuefy, for all new purchases made through online transactions through Invezta

Investment Platform.

Terms and Conditions - Invezta Investment Account facility for investments in mutual funds

This "Invezta Investment Account" facility ("Invezta

Investment

Platform") is provided by Valuefy Solutions Private Limited. ("VALUEFY") to enable the

investors to

carry out online transactions in the units of the mutual funds. VALUEFY is a registered distributor of

mutual funds with AMFI with ARN code 171537, and registered with the Securities and Exchange Board of

India ("SEBI") as an Investment Platform under SEBI(Investment Advisers) Regulations,

2013("IA

regulations") vide RIA code INA000000060 dated 2nd August 2013.

VALUEFY is registered with various AMCs as an Mutual Funds Distributor and shall facilitate online

transactions in mutual funds for its clients through its website

www.invezta.com [herein after

referred

to as "website"] and shall be responsible/ liable for all regulatory compliances /contractual

obligations with respect

to online distribution of units of mutual funds.

Invezta Investment Platform has entered into agreements with third

party technology service providers to link up with

Banks for offering various facilities through the internet, which

facilities and services including Net

Banking and payment settlement facilities in respect of payment

instructions initiated by the Investors using Online payment facility. Accordingly, Invezta Investment

Platform is available to those investors who hold bank account with these banks and have availed the

facility for online payments / Net Banking.

This facility is made available with respect to select Mutual Funds

only, with whom VALUEFY has entered into a separate arrangement and accordingly provides online platform

to deal in the units of the scheme of these mutual funds that are existing / launched / offered by them

from time to time.

By subscribing to Invezta Investment Platform , you agree and

accept to abide and be bound by these terms and conditions. You further agree to execute all the

necessary documents which may be needed from time to time, to send the necessary dealing details to the

Mutual Funds / their authorised Registrar & Transfer Agents (RTAs) to give effect to the dealings

made through Invezta Investment Platform.

1.

Registration Related Conditions

i. The Registration to Invezta Investment Platform is subject to

the satisfactory completion of the registration form and submission of all mandatory documents and valid

Permanent Account Number ("PAN") and its subsequent verification and KRA verification.

ii. Invezta Investment Platform can be activated for KYC

Registration Agency (KRA) verified investors only. Accordingly while enrolling for the Invezta

Investment Platform registration, your KRA verification process will be checked and you shall provide a

copy of valid PAN and proof of completion KYC through SEBI approved KYC Registration Agency ( KRA Agency

) or other details as may be prescribed from time to time and these details shall get verified with KRA.

iii. You agree and authorise Invezta Investment Platform to submit

all the KYC Documents (name, Pan, age, address and signature)/ investor related documents to the

respective Mutual Funds, Asset Management Companies and/ or their Registrar and Transfer Agents for the

purpose of validation and to comply with regulatory requirement notified from time to time. You agree

that signature available in the KRA records/systems would be used for signature verification for

processing any request made by you through the Website or direct transactions with AMC and in the event

such signature is not available or legible in KRA records/system, you understand and agree that the AMC

shall be entitled to carry out further checks to validate the authenticity of the request / or to

reject/ disallow any transaction in the connection herewith.

iv. Once it is ascertained that the investor is KRA verified

Invezta Investment Platform account would be activated. The account can be operated using your Invezta

Investment Platform user id and password. You agree and unconditionally confirm that you shall be solely

responsible to ensure protection and confidentiality of the user ID and password at all times and any

disclosure thereof shall be entirely at your risk and accept the sole responsibility to maintain the

secrecy of all information of confidential nature and shall ensure that the same is not disclosed to any

other person.

v. You agree that access to INVEZTA Account may be suspended /

cancelled /terminated without liability, in whole or in part, at any time without prior notice if you do

not comply with any of these Terms or any modifications thereof.

vi. You agree and understand that no change of address, mobile no.,

e-mail id and / or bank details can be allowed for such accounts, unless a duly signed hard copy of such

written request is sent to the AMC / CAMS / POS for signature verification and other formalities.

2. General Conditions

i. You grant authority to VALUEFY to process and transmit such request made by you through the Invezta Investment Platform account authenticated by the user ID and password and authorise VALUEFY to execute your instructions with regards to purchase /redemption /switch/sell or other transactions/ activities in respect of mutual funds on your behalf, as may be instructed by you from time to time, on the terms and conditions mentioned herein. When you provide consent (by logging in or by any other verification means) to being a part of the family account, the parent family account holder gets access to your information and can operate your account, including doing transactions, exactly as you would have logged in. You fully understand the obligations there and grant access of your account to be a part of family account, where you intend to. Valuefy cannot judge your relationships/partnerships with the parent account holder and in such cases the complete onus of providing access rests on you.

ii. You agree and confirm that VALUEFY and / or its authorised

representative is / are not in a position to verify that the dealings are indeed undertaken by you at

the time of dealing through the Invezta Investment Platform Account and VALUEFY shall be not held

responsible for any transactions arising out of the misuse of the password by any person other than you.

You shall be responsible for the systems used by you with respect

to dealings and for various security measures which you have to take to prevent unauthorised access to

details relating to the dealing through the Invezta Investment Platform account, and VALUEFY shall not

be liable for any such unauthorised access.

iii. You understand and agree that instructions given by you to

VALUEFY for transacting in mutual fund units will be forwarded to the AMC/R&TA in electronic log

file

format (‘Feed File') and AMC/R&TA will process the transaction on the basis of such Feed File

only.

And you hereby agree and consent to the transmission of data by electronic means through the Invezta

Investment Platform Account from the website.

iv. You agree that the data and information provided by you

pursuant to your dealing with VALUEFY could be shared by VALUEFY with its authorised

agents,representatives, affiliates, group companies and subsidiaries for facilitating transaction

processing, servicing, data processing, transaction statement generation and for contacting for new

products and services including but not limited to marketing, cross selling, business activities and

promotions or for generating reports, market research, customer study and for compliance with any legal

or regulatory requirements. You agree that submission of a transaction request through the Invezta

Investment Platform Account shall not be deemed to be acceptance of the transaction by Mutual Funds or

its RTAs and the transaction could be rejected if does not comply with the provisions of the Scheme

Information Document of the respective Mutual Fund or for any other reason which VALUEFY and / its

authorised representatives/Mutual Funds/RTAs deems fit.

v. There is no guarantee for any returns on investments made in

Mutual Fund scheme(s). Past performance mutual fund/schemes does not indicate the future performance of

the schemes and may not necessarily provide a basis of comparison with other investments

vi. Mutual fund and securities are subject to market risks and

there can be no assurance that the objectives of the schemes will be achieved.

vii. As with any investment in securities, the NAV of units issued

under the schemes can go up or down depending on the factors and forces affecting capital markets.

viii. You agree and authorize VALUEFY to communicate on your behalf

with the AMC's for financial and /or non-financial transactions

ix. The transactions carried out through the Invezta Investment

Platform Account in Units of various schemes offered by the Mutual Funds shall be subject to the

provisions contained in the respective scheme related documents including but not limited to Scheme

Information Document and Statement of Additional Information or any addendum thereto.

x. You agree to comply with KYC (Know your Client/Customer) and KRA

requirements as required under SEBI (KYC Registration Agency) Regulation 2011, SEBI Act 1992, Prevention

of Money Laundering Act,

2002, all laws and regulations including but not limited to the

Foreign Exchange Management Act, Reserve Bank of India (RBI) guidelines, to the extent applicable for

availing the Invezta Investment Platform account.

xi. You acknowledge that dealing through the Invezta Investment

Platform Account will be at your own risks. You shall solely be responsible to evaluate all the risks

arising out of the same. The risks would, inter alia include:

Internet Frauds

The Invezta Investment Platform Account may be susceptible to

number of frauds, misuse, phishing, hacking and other actions, which could affect instructions sent to

VALUEFY/its authorised representatives. There cannot be any guarantee from such internet frauds,

phishing, hacking and other actions.

The susceptibility of the Invezta Investment Platform Account to

virus(es) or other malicious, destructive or corrupting codes or programs.

You agree that by use of Invezta Investment Platform , you shall be

deemed to have agreed and accepted all the terms and conditions and such terms and conditions shall be

binding on you in the same manner as if you have agreed to the same in writing.

You further agree and acknowledge that the Mutual Fund/Asset

Management Company will act only on the electronic transaction data forwarded by VALUEFY and will be

under no obligation to verify and/or confirm the authenticity of such transactions including the

content, source etc. You hereby confirm that you will not hold the Mutual Fund/Asset Management Company

liable and/or responsible for any loss/damage that you may incur as a result of any such improper use of

your password/Investment Services Account.

You agree and acknowledge that the filling in of transaction

data/instructions for onward forwarding to the Mutual Fund/Asset Management Company would require you to

incorporate proper, accurate and complete details. In the event of your account receiving an incorrect

credit by reason of a mistake committed by any third party, the concerned mutual fund / asset management

company or the bank shall be entitled to reverse the incorrect credit at any time without your consent.

You shall be liable and responsible to VALUEFY/ concerned mutual

fund / concerned asset management

company for any unfair or unjust gain obtained by you as a result

of the incorrect credit.

The mutual funds / asset management companies may at its discretion

not give effect to your transactions where the mutual fund / asset management companies have reasons to

believe (which decision of mutual fund / asset management companies, you shall not question or dispute)

that the transactions are not genuine or are otherwise improper or unclear or raise a doubt. The

respective mutual fund/asset management company shall not be liable for the loss of any opportunity

costs incurred by you, if any transactions are not carried out for any reasons whatsoever. You

understand that any payment made by you towards such transactions will be refunded to your account,

after deduction of charges, if any.

You understand that you may communicate directly with the Mutual

Fund/Asset Management Company to resolve any clarifications that you may have pertaining to your

investments in the Mutual Fund Schemes.

In the event an Account is jointly held, you acknowledge that all

instructions (including instructions for modification of this clause) shall be given only by the first

holder of such Account, on behalf of all of you and for this purpose, The joint investors, irrevocably

constitute the first holder above as your agent. All instructions given by the first holder above shall

be binding on all of you as if given by each of you personally. You hereby authorize VALUEFY to process

and transmit such instructions given from time to time in relation to your transactions to the

respective mutual funds / asset management companies. The mode of holding in all customer joint accounts

is treated as "Anyone or Survivor".

3. Transaction Processing Related

Conditions

i. The online requests will be executed based on the instructions

of investors registered for - Invezta Investment Platform Account. You agree and confirm that all the

authorised and complete transactions will be processed at the applicable NAV (as defined in the Scheme

Information Document of respective schemes of Mutual Funds) subject to receipt of funds and acceptance

of your transaction by the Mutual Funds/ RTAs.

ii. You agree not to hold VALUEFY / its authorised representatives

liable for any loss that may arise to you as a result of the incorrect NAV applied on units allotted to

you by the Mutual Fund.

iii. The money debited from your Bank Account shall be collected in

the pool account of the third party service provider and from there it will be credited / transferred to

the respective Mutual Funds either on the same day or the next working day. Hence, you agree, understand

and acknowledge that there would be an interim time lag in transferring / crediting the money from the

pool account of the third party service provider to the respective Mutual Fund account.

iv. You agree that when subscription for mutual fund units are

remitted through joint bank accounts of investors, the default option for applying for mutual funds unit

would be in the joint names of all the account holders of the bank account. If the payment is not made

from a Registered Bank Account or from an account not belonging to the first named unit holder, your

transaction will be rejected.

Additionally, investors shall also have an option to apply for

units in single name of any one or more names of the joint account holders of the bank account with

nomination facility subject to terms and conditions of the relevant SID. You agree that in joint account

holding, decision of First holder as mentioned above in clause 2 is binding on others.

v. The units of the schemes shall be allotted, redeemed or

switched, as the case may be, at the Net Asset Value (NAV) prevalent on the date of the transaction

request by the Mutual fund, if the request for purchase, redemption or switch is placed before the

cut-off time.

vi. You agree that any transaction request falling due on a holiday

or after the cut off time mentioned on the website would be processed on the next working day and

respective NAV would be applicable as per the Mutual Fund's Scheme Information Document. The cut-off

timings will be prior to the statutory cut-off timing specified under the SEBI Regulations and the

Scheme Information Document for operational convenience.

vii. Holiday means banking holidays as applicable in Mumbai, India.

The transactions once placed cannot be cancelled.

viii. In respect of purchase of units of mutual fund schemes (other

than liquid schemes), the closing NAV of the day on which the funds are available for utilization shall

be applicable for application amount equal to or more than Rs 2 lakh or such other value as may

specified from time to time, irrespective of the time of receipt of such application.

xi. VALUEFY /its authorised representative/service provider does

not take any responsibility for any delay in acceptance / execution or non-execution / rejection of the

order by the AMC. Once the information is provided by the Mutual Funds for the rejection and Investor

will be informed accordingly.

xii. You agree that there may be a time lag between the time a

transaction is completed and before the same is updated in the records of VALUEFY /its authorised

representatives/service provider.

xiii. There may be a possibility of variances in values arising out

of delayed data feeds, transmission losses in electronic data, electronic fund transfer etc. for which

VALUEFY /its authorised representatives/ shall not be liable.

xiv. You agree to maintain clear balance in your Bank Account at

all times to cover the purchase price and other costs and charges / quantity of units. You are advised

to check your daily fund transfer limits with your Bank before placing the purchase transaction / units

in the particular scheme before placing a purchase/SIP request.

xv. In absence of sufficient funds (in case of purchase) / lesser

quantity of units (in case of sell/ switch), VALUEFY /its authorised representative/service provider

shall not be responsible for the non execution / rejection of your instructions.

xvi. In case of Redemptions, if the number of Units held by the

Customer as per the records maintained by AMC and/or the Authorized Registrar is less than the number of

Units requested to be redeemed, then the available units will be redeemed. Wherever redemption of "all"

units is specified in the request, all Unit holdings in that Scheme shall be redeemed. All Redemptions

shall be subject to the provisions mentioned in the respective Offer Document / Scheme Information

Document and addenda thereto issued from time to time.

xvii. You agree that the payment for the transactions undertaken by

you through Invezta Investment Platform Account will be facilitated through a payment gateway and the

VALUEFY/its authorised representatives/ service provider shall not be liable for any failures in the

link or for any fraud (either payment gateway? s and/or bank? s end) that could take place at the time

of at the time of making payment and you shall inform VALUEFY /its authorized representatives/service

provider immediately if the your bank account is debited and wherein corresponding Units have not been

allotted.

xviii. In case of rejection of your purchase request by the mutual

fund, the amount will be credited into your bank account only after the receipt of the refund from the

relevant Mutual Fund.

xix. Redemption proceeds and dividend payouts shall get credited

directly by the AMC into your bank account provided at the time of registration with Invezta Investment

Platform . Provided, the bank account provided by you is from the list of banks with which the Mutual

Fund has a direct credit arrangement. The list of such banks is mentioned in the Scheme Information

Document or Key Information Memorandum (KIM) cum common application form of the respective Mutual Fund.

xx. All the purchase transactions pertaining to mutual funds made

on the website shall be allotted an online folio number and you will be able to access the transaction

account statement in electronic

format. You will receive the Accounts Statements directly from the

AMCs/RTAs.

xxi. You agree and acknowledge that transactions done through

Invezta Investment Platform will be tagged with the ARN Code of VALUEFY (171537) will be treated as

regular.

xxii. The Customer has unfettered and unrestricted access to the

Mutual Fund/ AMC and can transact in the same folio for financial / non-financial transactions without

routing the transaction(s) through VALUEFY.

xxiii. In the event of the termination of the agreement of VALUEFY

with the Mutual Fund/AMCs, you would not be allowed to execute through the website any transaction

including but not limited to a transaction for Purchase, Redemption, etc of the Units of that Mutual

Fund. In such cases, VALUEFY will pass on / make available all your details to the Mutual Fund/AMCs, as

are required by them to enable you to deal and interact directly with the AMCs/Mutual Fund from the

date of such termination.

xxiv. The payment gateway used for online subscription of units

could also include debit card/IMPs.

Such facility is enabled through third party technology service

provider and would be available for selects banks and shall be subject to such conditions and

limitations as may be applicable from time to time. You may get a levy/ charges separately by your bank

which you must check before availing this facility. However, credits card will not accepted for purchase

of mutual funds.

xxv. There may be applicable exit load/any other charge levied by

the Mutual Funds will be chargeable in accordance with the Scheme Information Documents(SID) /Key

Information Memorandum (KIM) and addendums issued thereto from time to time (collectively referred to as

"scheme related documents"). You shall read all the scheme related documents before investing.

xxvi. Investments from residents in the United States of America

and Canada are permitted for certain mutual funds as communicated by Invezta Investment Platform .

Invezta Investment Platform shall not be liable for rejections of such applications by Mutual Funds,

where investor is an US and Canada resident.

xxvii. Invezta Investment Platform facility is not offered nor is

the Fund managed or intended to serve as a vehicle for frequent trading that seeks to take advantage of

short term fluctuations in the market, hence you agree and acknowledge that the Mutual Funds or its

authorised registrars [RTAs] in it's sole discretion may reject any purchase or exchange of Unit that it

reasonably believes may represent a pattern of market timing activity involving the funds of the Mutual

Fund

4. Reverse Feed & Portfolio Reporting Related Conditions

You authorize VALUEFY for receiving the Client's investment details

and reverse feed files from the AMC & RTA/s. You hereby give consent to share/provide the transactions

data feed/portfolio holdings/ NAV etc. in respect of your investments under direct plans of all schemes

managed by Invezta Investment Platform tagged with the AMFI Registered ARN Code of VALUEFY (171537).

5. Instructions For Nomination

i. Nomination shall be mandatory for new folios/accounts opened by

individuals especially with sole/single holding and no new folios/accounts for individuals in single

holding shall be opened without nomination. However, in case investors do not wish to nominate must sign

separately confirming their non-intention to nominate, failing which the form may be rejected at the

discretion of the AMC/Mutual Fund.

ii. Unit holder can nominate (in the manner prescribed under the

SEBI Regulations), maximum upto 3 person(s) in whom the Units held by him/her shall vest in the event of

his/her death. It shall be mandatory to indicate clearly the percentage of allocation / share in favour

of each of the nominees against their name and such allocation / share should be in whole numbers

without any decimals making a total of 100 percent. In the event of the Unit holders not indicating the

percentage of allocation / share for each of the nominees, the AMCs, by invoking default option shall

settle the claim equally amongst all the nominees.

iii. In case of more than one nominee, please obtain additional

form as available on the website and follow the instruction for providing the nomination details

therein.

iv. Nomination made by unitholder shall be applicable for

investments in all the Schemes in the folio or account and every new nomination for a folio or account

will overwrite the existing nomination. Thus, a new nomination request will imply simultaneous

cancellation of existing nomination and request for fresh nomination.

v. The nomination can be made only by individuals applying for /

holding units on their own behalf singly or jointly in favour of one or more persons. Non-individuals

including society, trust, body corporate, partnership firm, Karta of Hindu Undivided Family, holder of

Power of Attorney cannot nominate. Nomination form cannot be signed by Power of attorney (PoA) holders.

vi. In case a folio has joint holders, all joint holders should

sign the request for nomination /cancellation of nomination and submit the same in physical form, even

if the mode of holding is not "joint".

vii. A minor can be nominated and in that event, the name and

address of the guardian of the minor nominee shall be provided by the unit holder. The Applicant is

advised that, in case of Single Holding, the Guardian to a Minor Nominee should be a person other than

the Applicant.

viii. Nomination can also be in favour of the Central Government,

State Government, a local authority, any person designated by virtue of these offices or a religious or

charitable trust. The Nominee shall not be a trust (other than a religious or charitable trust),

society, body corporate, partnership firm, Karta of Hindu ix. Undivided Family or a Power of Attorney

holder. A non-resident Indian can be a Nominee subject to the exchange controls in force, from time to

time.

x. Nomination shall not be allowed in a folio/account held on

behalf of a minor.

xi. Nomination in respect of the units stands rescinded upon the

transfer of units. Transfer of units in favour of a Nominee shall be valid discharge by the AMC against

the legal heir.

xii. The cancellation of nomination can be made only by those

individuals who hold units on their own behalf single or jointly and who made the original nomination.

xiii. On cancellation of the nomination, the nomination shall stand

rescinded and the AMC shall not be under any obligation to transfer the units in favour of the Nominee.

xiv. HDFC Mutual Fund requires a physical nomination form to be

sent to them to add nominees against your investments. If you need to add nominee(s) for investments

with HDFC Mutual Fund, a physical nomination form signed by all the account holders is required.

6. Indemnification

i. You agree to keep indemnified and hold VALUEFY / its authorised

representatives, service providers, Mutual Funds, Asset Management Companies and their officers and

agents free and harmless at all times, against all monetary and other harm, injury, costs, losses,

liabilities, damages, charges, actions, legal proceedings, claims and expenses and consequences

including without limitation any costs between attorney and client, wh+ether direct or indirect, by

reason of using Invezta Investment Platform account and/or doing and/or omitting to do anything in

accordance with the Terms specified herein or any instructions relating to the online dealing in mutual

funds through Invezta Investment Platform .

ii. You agree that VALUEFY / its authorised representatives/service

providers, Mutual Funds, Asset Management Companies and their officers and agents are not liable for any

loss caused through a fall in value of investments / NAV etc which can go up or down depending on the

factors and forces affecting capital markets or any indirect, special or consequential loss you might

suffer.

iii. You agree not to hold VALUEFY / its authorised

representatives/service providers liable for any loss or damage caused by reason of failure / refusal or

delay of the mutual fund to deliver any units purchased even though payment have been effected for the

same or failure / refusal or delay in making payment in respect of any units sold though they may have

been delivered and you shall save Invezta Investment Platform / its authorised representatives/service

providers harmless and free from any claim in respect thereof. VALUEFY / its authorized

representatives/service providers shall also not be liable for any delay, failure or refusal of the

Mutual Funds or its authorised agent / RTAs in registering or transferring units to your names of for

any interest, dividend or other loss caused to you arising there from. VALUEFY / its authorised

representatives/service providers shall not be liable for any delay / refusal / non-payment of any

proceeds on redemption or dividend payouts by the Mutual Funds to your accounts for any reason

whatsoever.

iv. You agree and undertake not to hold VALUEFY / its authorized

representatives/service providers for the following:

a. any delay or failure in processing the transactions carried out

by you due to any system failure or for any other reason whatsoever.

b. for any loss or damage incurred or suffered by you due to any

error, defect, failure or interruption in the dealing arising from or caused by any reason whatsoever.

c. for any fraud, negligence/mistake or misconduct by you including

failure to comply with the KRA/KYC norms or provision of a valid PAN or PMLA requirements.

d. for any breach or non-compliance by you of these Terms.

e. for not permitting you to deal after such reasonable

verification as VALUEFY /its authorised representative may deem fit.

f. for permitting any person who provides Mutual VALUEFY/ its

authorized representatives/service providers with the password to deal with Invezta Investment Platform

Account.

VALUEFY / its authorised representatives/service providers shall be

under no obligation to further ascertain your identification at the time of transactions.

g. for any loss or damage incurred or suffered by you due to

withdrawal or termination or suspension of the dealing facility arising from or caused by any reason

whatsoever.

v. You agree that this undertaking shall be valid until such time

you have not expressly informed in writing that you do not wish to deal or transact any longer and it

shall be also valid in respect of any claims made on account of or relating to your dealing with VALUEFY

.

vi. If the foregoing limitation is held to be unenforceable, the

maximum liability of VALUEFY / its authorised representatives/service providers to you shall not exceed

the amount of convenience fees / service charges paid by you for availing the services through the

Website.

7. Suspension & Termination

i. The Invezta Investment Platform facility / services may at any

time be suspended / disallowed /modifed for such reason and for such time period as deem fit like

inactive / dormant user id, noncompliance of the terms stated herein, death, insolvency, bankruptcy of

the investor, any other cause arising out of the operation of law or such other reason as deems proper.

ii. Invezta Investment Platform facility may be terminated by

giving you 30 days intimation/notice to your registered e-mail id or by way of SMS to your registered

phone number. You may terminate the dealings at any time by giving Prior written notice or deactivation

of your user id and password. In the event of termination for any reason whatsoever, you shall be liable

to pay all outstanding charges and dues, if any.

iii. In case you cease to be a Investor/Customer of VALUEFY then

all your details will be provided to the Mutual Fund/AMCs and as are required by them to enable you to

deal and interact directly with the

AMCs/Mutual Fund Notwithstanding anything stated above, kindly note

that you have unfettered and unrestricted access to Mutual Fund/AMC and you may approach the Mutual

Fund/AMC directly any time.

8. Amendments

These terms and conditions may be amended for such reason as deem

fit and proper including but not limited to comply with changes in law or regulation, correct

inaccuracies, omissions, errors or ambiguities, reflect changes in the process flow, scope and nature of

the services, company reorganization or Investor requirements.

9. Intellectual Property Rights

All rights to this Website, the content displayed on the website

and / or for providing Invezta Investment Platform Account facility and/or technology (in any form) made

available to you as a part of or in conjunction with the Services are the intellectual or proprietary

properties of the VALUEFY. These intellectual property in all material provided on the website

(excluding any applicable third party materials) is held by VALUEFY unless otherwise stated. Except as

expressly permitted herein or on the website, none of the material provided on the website may be

copied, reproduced, distributed, republished, downloaded, displayed, posted, transferred or transmitted

in any form or by any means, including, but not limited to, electronic, mechanical, photocopying,

recording, or otherwise, without the prior written permission of the VALUEFY. Further, you shall not

transfer, reverse engineer, decompile, disassemble, modify or create derivate works based on the

materials provided on the Website.

The copyright, trademarks, service marks, registered designs,

database rights, patents and all similar rights in and relating to the website arising or subsisting in

any country in the world and the information contained in it are owned by VALUEFY, its licensors or

relevant third party content providers. Nothing on the website should be construed as granting, by

implication, estoppels or otherwise, any license or right to use any trademark displayed on the website

without the written permission of VALUEFY or its relevant affiliate.

You also agree not to use any information available on the website

for any unlawful purpose, and you shall comply with all instructions and directions issued if any to

protect the respective rights in the information.

10. Disclaimer

i. Mutual Fund investments are subject to market risks, read all

scheme related documents carefully before investing.

ii. The data, reports and information provided on the website does

not constitute an investment recommendation and therefore should not be relied upon while taking

investment decisions. You are therefore advised to obtain applicable legal, accounting, tax or other

professional recommendation or services before taking an Investment decision. The Client understands

that the recommendation, views, articles, reports, and other contents are provided on an "As Is" basis

by Invezta Investment Platform and that use of this service is at his /her own risk. Further he / she

understands that Invezta Investment Platform does not warrant completeness or accuracy of the

information provided and Invezta Investment Platform shall not be responsible or liable for any losses

incurred by me for acting based on the views expressed under this service. Further, he/she agrees that

Invezta Investment Platform shall not be liable for errors, omissions disruption, delay, interruption,

failure, in providing the service for reasons beyond its control.

iii. The transaction execution services and the data, reports and

information and recommendations, if any provided are incidental to the distribution services of VALUEFY

and shall not in any manner be constructed as offering of any kind of investment platformy services or

any kind of legal, tax or financial recommendation. Further it shall also not mean that any of VALUEFY's

employees or associates have been in any way involved in your decision making process. The investment

decision, if any, will be taken by you in your sole and absolute discretion.

iv. All benefits on investments will be as per the provisions of

Income Tax Act 1961 as amended from time to time.

v. This service does not constitute an offer to buy or to sell or a

solicitation to any person in any jurisdiction where it is unlawful to make such an offer or

solicitation.

vi. VALUEFY/its authorised representative/service providers is not

responsible for any omissions, errors or investment consequences arising from the use of the materials

available on the website.

Whilst every reasonable precaution has been taken to ensure the

accuracy, security and confidentiality of data and information available through the Invezta Investment

Platform Account, VALUEFY/its authorised representative/its service provider shall not be held

responsible for any consequence of any action carried out by you.

viii. The services/facility may suspend or withdrawn at any time,

and you acknowledge that the Invezta Investment Platform account is also subject to interruption.

ix. You acknowledge and agree that the Website and the linked

backend infrastructure may be inaccessible and/or unavailable at times. In such an event VALUEFY will

not be liable for any damage, liability, action, cause of action, suit, claim, demand, loss, cost, and

expense arising directly or indirectly from or in connection with such system inaccessibility and/or

unavailability.

x. VALUEFY makes no express or implied warranty:

a. that the dealing through Invezta Investment Platform account

will be uninterrupted or free from errors or that any identified defect will be corrected;

b. that the Invezta Investment Platform service is free from any

virus or other malicious, destructive or corrupting code, program;

c. in relation to non-infringement of any third party rights,

merchantability, satisfactory quality or fitness for a particular purpose.

xi. VALUEFY/its authorised representative and its service provider

shall not be liable for any loss or damage or other consequences arising from any suspension, breakdown,

withdrawal, interruption, technical flaw, the presence of virus or other malicious, destructive or

corrupting code, programs over the Invezta Investment Platform Account or otherwise and any consequent

delay or failure in completion of any payment or other instructions as a consequence thereof arising

from the use or inability to use the Invezta Investment Platform Account.

xii. VALUEFY/its authorised representative and its service provider

shall not be liable for any failure to perform any of its obligations or service standards etc if the

performance is prevented, hindered or delayed by a Force Majeure Event, which includes any event due to

any cause beyond the reasonable control including, without limitation, unavailability of any

communication system including Internet, breach or virus in the processes or payment mechanism,

sabotage, fire, flood, explosion, acts of God, civil commotion, strikes or industrial action of any

kind, riots, insurrection, war, acts of government, computer hacking, unauthorized access to computer

data and storage devices, computer crashes, breach of security and encryption codes.

xiii. The Investment Profile of the Client is prepared by Invezta

Investment Platform / VALUEFY and is based on Invezta Investment Platform / VALUEFY's understanding of

assessing risk and suitability in line with the objectives and requirements of the Client as per the

details provided. Invezta Investment Platform / VALUEFY may use the information provided herein for the

purposes of undertaking an internal "risk assessment" of the Client. The series of questions herein may

help Invezta Investment Platform / VALUEFY to appraise the Client's risk profile, particular needs,

financial situation, investment objectives and investment in financial instruments. However, please note

that the questions are only meant to be a guide to help determine the Client's profile and shall not be

considered to be conclusive. The Client is required to ensure that the Client has provided accurate and

complete information. The Client is aware, acknowledges and agrees that if the Client provides

inaccurate and/or incomplete information, and/or chooses not to disclose certain information, such

action will adversely affect the results of the risk assessment. Invezta Investment Platform / VALUEFY

may provide information in relation to the purchase/sale of financial instruments on the basis of such

internal risk assessment. However, this risk assessment is for internal purposes alone and does not in

any manner guarantee or represent that the information provided/to be provided to the Client will take

into account the individual characteristics of the Client and/or will be suited to the Client's

individual tax/legal/financial circumstances or needs. Any suggested investment is based on information

provided by the Client and is only one of the many combinations of investments that may be suggested to

someone with the Client's risk profile. The information provided by Invezta Investment Platform /

VALUEFY to the Client is not to be construed as investment recommendation of any type. Invezta

Investment Platform / VALUEFY is not obliged to give any recommendation or to make recommendations to

the Client. Client will not solely rely on the views, representations (whether written or oral or

otherwise), recommendations, opinions, reports, analysis, information or other statement made by Invezta

Investment Platform / VALUEFY or any of its agents, directors, officers or employees and that the Client

will make the Client's own assessment and rely on the Client's own judgment in making any investment

decision. In the event that the Client seeks to make an investment pursuant to the information or

recommendation provided by Invezta Investment Platform / VALUEFY, the Client shall do so at its/his/her

own risk, and should consider its/his/her financial situation, objectives and needs and consult with

its/his/hers legal, business, tax and/or other professional platforms to determine the appropriateness

and consequences of such an investment. The Client may, at his/her/its own discretion, opt not to follow

the investment / product / recommendations provided by Invezta Investment Platform / VALUEFY,

irrespective of whether they are in line with the objectives / requirements specified in this document

or the assessment derived from the details provided herein. Invezta Investment Platform / VALUEFY and/or

any of its subsidiaries/group companies/agents/vendors along with all their Directors/officers/employees

and agents shall not be responsible for the amount / value of profit earned / loss incurred by the

Client or its variance from the mean / any other ratio used to evaluate the returns from the mutual

funds/ market / alternate products / portfolios, that the Client may have earned. Third Party Investment

products are not obligations of or guaranteed by Invezta Investment Platform / VALUEFY or any of its

affiliates or subsidiaries, and are subject to investment risks and foreign exchange risks, including

the possible loss of the principal amount invested. Past performance is not indicative of future returns

and the prices and/or returns may change (go up or down) from time to time. This document does not

constitute the distribution of any information or the making of any offer or solicitation by anyone in

any jurisdiction in which such distribution or offer is not authorized or to any person to whom it is

unlawful to distribute such a document or make such an offer or solicitation. Investment products may

not be available in all jurisdictions. The Client shall notify Invezta Investment Platform / VALUEFY of

any material change in its/his/her situation and/or profile and Invezta Investment Platform / VALUEFY is

entitled to rely on the most recent information provided by the Client.

xiv. Investors who subscribe for Invezta Investment Platform

premium services hereby understands that he/she needs to pay entire annual platformy fees in advance. He

/ She also understands that under "pay if it works" offering, investors would get credit for amount that

is equal to the platformy fees in his Invezta Investment Platform account only for period wherein the

portfolio of schemes recommended by Invezta Investment Platform underperforms the category average

return. Invezta Investment Platform would evaluate the recommended portfolio performance with category

average return at the end of every quarter. For example - If the portfolio recommended by Invezta

Investment Platform underperforms in one quarter in a year, investor will get credit for amount that is

equal to the platformy fees for 1 quarter. The Client also understands that the Platformy fees exclude

transaction and platform fees. The Client can redeem this credit while subscribing to any services on

Invezta Investment Platform.

xv. The Client who subscribe for any services on Invezta Investment

Platform agrees that subscription charges (including taxes etc.) paid are non-refundable including in

case of deactivation, unsubscribing the services or in any other circumstances.

xvi. The Client understands that he/she can upgrade from existing

plan anytime during his subscription period wherein the charges as applicable will be charged on the

pro-rata basis. He/she also understands that he can't downgrade from existing subscribed plan anytime

during the subscription period. However, at the time of renewal of the service, he/she can subscribe to

any plan for his / her choice.

xvii. The Client understands that the information under the plan

shall be provided through online on invezta.com, his/her email id and mobile number registered with

Invezta Investment Platform. In case of any change in his/her email id and/or mobile number, he/she

shall inform Invezta Investment Platform in advance in the prescribed format to carry out the necessary

changes in its records. He/ She confirm that the information/details provided by him /her is true,

accurate, correct and complete.

xviii. The Client confirms that Invezta Investment Platform shall

have the right to withdraw the plan at any time without providing any reason whatsoever and without

giving any prior notice. He/She further confirm that in case of withdrawal of the facility by Invezta

Investment Platform, proportionate refund will be provided for the balance period, if any.

xix. The Client is aware that in the process of subscribing to the

Plan by him /her, Invezta Investment Platform may obtain information including that of a confidential

nature and that this information will be used by Invezta Investment Platform for its internal purposes

and will be kept confidential. He/She understands that Invezta Investment Platform reserves the right to

disclose personal information where it believes in good faith that such disclosure is required by law.

xx. The Client agrees to be contacted by Invezta Investment

Platform and its representatives over phone or on registered email id with reference to the service.

xxi. The Client agrees not to use the information provided under

the service to any third party including any discussion Forums or for any unauthorized illegal purpose.

He/She also agrees to use the information provided under the plan strictly for personal purpose.He/She

shall not recompile, disassemble, copy, modify, distribute, transmit, display, perform, reproduce,

publish or create derivative works from, transfer, or sell any information, services etc accessed under

this plan or otherwise. By viewing the contents of this plan, he/she agrees that any unauthorized use

shall be unlawful and may subject to civil or criminal penalties.

xxii. The Client agrees & confirm that if his/her mobile number is

registered in the Do Not Disturb (DND) list of TRAI, he/she may not receive SMS from Invezta Investment

Platform. He/She shall take steps to deregister from the DND list and shall not held Invezta Investment

Platform liable for non-receipt of SMS in the interim period.

xxiii. The Client confirms having read, accepted and understood the

features of the subscription plan, applicable charges, privacy policy, related FAQs and the Standing

Instructions.

xxiv. The Client agrees to the above Terms & Conditions and hereby

authorize Invezta Investment Platform to debit his Bank Account linked to his/her Invezta Investment

Platform account towards subscription charges (including taxes).

xxv. The Client understands that he/she can close the Invezta

Investment Platform account or unsubscribe to any services anytime by writing an email

on

contact@invezta.com.

He/She also understands that any kind of subscription charges paid by the

customer are non refundable.

11. Confidentiality

VALUEFY shall make reasonable efforts to keep all the information

relating your dealings through Invezta Investment Platform Account confidential. Provided however that the

VALUEFY shall be entitled to disclose any information or particulars pertaining to you to any authority,

statutory or otherwise as may be required by law or third party service provider required to effect the

transactions requested by you.

12. Governing Law and Jurisdiction

In case of any dispute, either judicial or quasi-judicial the same will

be subject to the exclusive jurisdiction of the courts in Mumbai. These terms shall be construed in

accordance with the laws prevalent in India and are subject to SEBI guidelines, circulars, press releases or

notifications that may be issued by SEBI from time to time or the Government of India, to regulate the

activities of Mutual fund intermediaries (Registered Investment Platforms).

13. Disciplinary Actions

No disciplinary action has been taken on the company by any regulatory

authority in the past.

14. T&C for Online Systematic

Investment Plans (SIP) through NACH/ECS mandate

i. You understand and acknowledge that there could be a minimum time

gap of at least 30 days from the date of submission of physical mandate, to enable the activation /

registration of online SIP facility, subject to the successful validation of the mandate by the Banks.

Likewise there shall be a minimum gap of alteast 30 days from the date of receipt of SIP deactivation

mandate and last investment made under SIP.

ii. Upon successful registration of mandate, you can start the online

SIP facility for making investment in mutual funds a fixed amount of money at a fixed frequency of time

based on your convenience and choice.

iii. You grant Authority to VALUEFY/ its authorized payment processing

service provider (third party service provider) to debit your registered Bank Account through RBI'S ECS

(Electronic Clearing System) mechanism or National Payments Corporation of India's NACH (National Automated

Clearing House) to enable the collection of the SIP installments and transferring to the respective AMC? s

bank account. The conditions related to NACH are applicable as and when such a facility is made available.

iv. You agree and acknowledge that in order to enable you to get the

NAV on the SIP date (T date) chosen by you, debit of the SIP amount from your Bank Account shall happen few

days prior to the SIP date (T). e.g. T-2, T-4 etc., depending upon ECS / NACH debit cycle of your Bank,

which could vary from location to location, as per ECS / NACH mechanism. You understand and acknowledge

that, VALUEFY/ its third party service provider shall do a backward calculation from T date and depending

upon ECS / NACH debit cycle, your account will be debited on T - no. of days, such that on T date (SIP day),

the funds reach the respective AMC's Bank account and the transaction data reach the respective registrar of

AMC, to enable them to allot units as per NAV on T date.

v. You agree and shall ensure to keep sufficient funds available in

your Bank account at least 7 days prior to SIP date (T date). You understand and acknowledge that SIP

installment and allotment of units shall be subject to realization of funds. You shall not hold VALUEFY/its

third party Service Provider liable, in case the SIP installment process could not be completed due to

insufficient funds in your Bank account on any particular ECS / NACH debit cycle date i.e. on T - no. of

days. In such case, the SIP installment shall lapse for that T of the month/quarter/half year/year as the

case may be.

vi. You agree, understand and acknowledge that in the entire process

there would be an interim time

lag in debiting the money from your Bank Account and the actual

transferring / crediting to the respective AMC's Bank account, as the money after the debited from your Bank

Account shall be lying in the ECS / NACH debit cycle and / or third party pool account, before the actual

transfer of funds to AMC's bank account on SIP date.

vii. You can view the units allotted by AMC/registrar on the next day

of SIP date (i.e. SIP day + 1 working day).

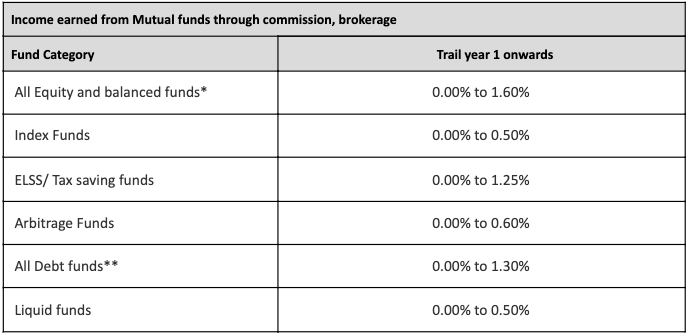

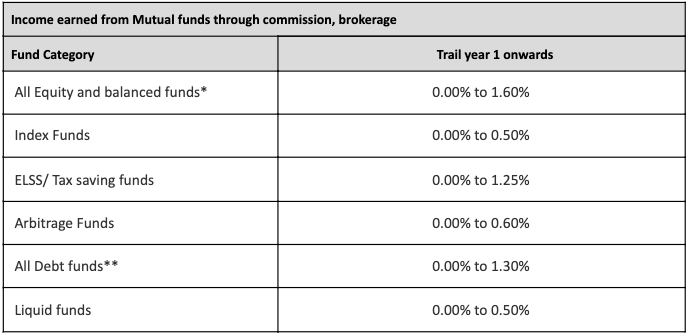

15. Commissions

Following are the details of the commission earned by Valuefy Solutions Private Limited from various fund-houses:

* All equity funds includes flexi cap funds, Aggressive Hybrid, large, mid & small cap funds, international funds etc

** All debt funds includes Gilt, Income, short term & corporate bond funds, floating rate funds etc

^ Product providers share commission on a trial only basis. The above rates are on annualized basis

For investors in Mutual Funds from B-30 locations, an additional commission of 0%-1.5% will be paid from AMC's

The disclosure is in accordance with SEBI circular no SEBI/IMD/CIR No. 4/ 168230/09 and RBI circular no DBOD.No.FSD.BC.60/24.01.001/2009-10 dated 16/11/2009

Asset Management Company (AMC) may change rates, periodically etc. of commission /trail commission in case of change in regulations / expense ratio and any other factors which have an impact.

Details of Scheme level commission on Mutual funds are available with the Relationship Managers and would be produced on demand.

Valuefy Solutions Private Limited acts as a distributor of Mutual Funds wherein it distributes products of various mutual funds.

Note: All commissions are earned only in trail.